First, I'm trying to keep this CR free. Thanks to all of you for the information sharing on so so many related subjects. I walk away for half a day, and damn, ... shit moves fast around here!

So,

There are 3 contries that are the pillars of O&G production that control, through production or influence, the balance of worldwide supply & demand; The US, Saudi Arabia & Russia. The US has always had the reserve base to meet European demand, but maximizing production, at moderate oil prices, has not been the goal of the US since the early 80's. Germany and the EU looked to Russia, because neither the US, nor anyone else, was available. We ignored her, she left for a wife beater, and here we are.

When the 2020 denominator is tiny, any increase in 2021 will lead to record earnings. Did the companies that went bankrupt or were consumed in "mergers" also post record earnings?

If Chevron makes $8 Billion/year, is that too much? That's about what they payout in dividends. To keep production flat and just offset declines, and save some for a rainy day, they need to make a lot more than that.

Thank you.

Vertically integrated means they make money on production, refining & petrochemicals, and marketing & trading. Usually, they make money in 2 out of 3, no matter how hard they try. The independent production companies (no downstream integration), the smaller guys that drill most of the wells, live and die with roller coaster prices. By defintion, they have to sell someone to the integrated companies and independent refiners and pet-chems.

The midstream industry, infrastructure gathering, compression, processing & pipelines, is all built on term, take or pay contracts, meaning they pay for the service whether they use it or not. Even when it's uneconomic to drill and produce, they are still contractually obligated to pay the midstream fees. They start up and a lot of them go bankrupt. When the price is right and capital is plentiful at low borrowing rates, drill, baby drill. With the anomalies in supply & demand & price fundamentals, tight capital, and rising interest rates, the gas you get is going to be impacted by a constant foot riding the brakes.

A Q-Max a day is ~ equivalent to Nordstream 2. Longhaul pipelines, with 100's of supply sources, are basically 24/7/365. LNG Shipping, a single source supplier, is impacted by supply disruptions, fog, blocked canals, labor strikes, etc ..., something less than 24/7/365.

Current US LNG capacity is ~ 12 BCF/day, LNG capacity under construction ~ 6 BCFD

Nordsteam Pipelines 1 &2 gas to Europe total ~ 11 BCFD.

Pipelines and midstream assets are fee based asset companies. Production companies are commodity based. Volume/fee guarantees =/= commodity price guarantees? Is Putin's invasion Force Majuere? an "act of god"?

O&G price forecasting is a combination of darts and hitting a pinata with a blindfold. The O&G risk profile is marginally different than FAANGs.

"record profits this quarter": ... forward looking forecast based on past events will have no bearing on future results? Not wise to commit to a substantial increase in borrowing and capital spending at $10 million/well based on a quarterly result.

My starting point is "the trend is your friend", but some how forceast an Enron, or Katrina, or Covid or Putin.

No hydraulic fracturing, no pipelines, no facilities >> No production + no transportation + no market = canceling gas growth.

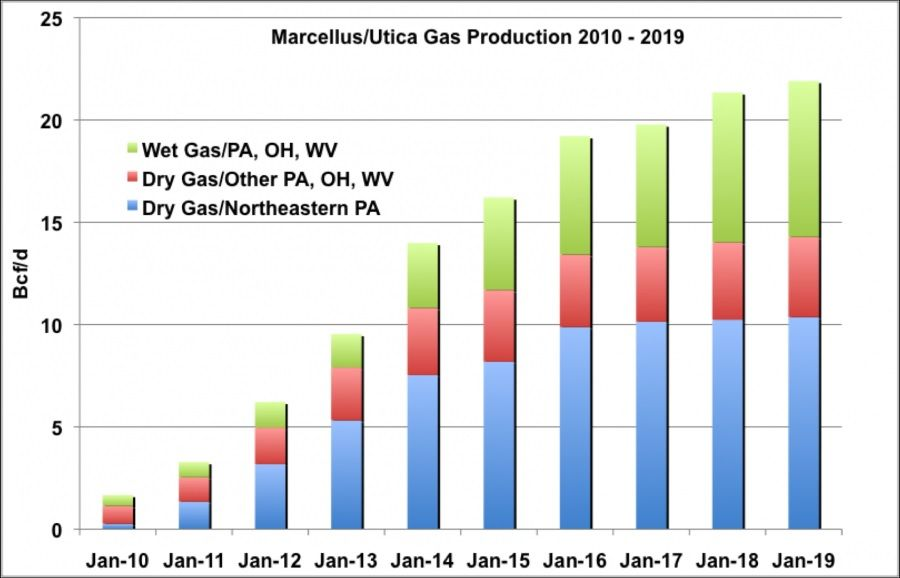

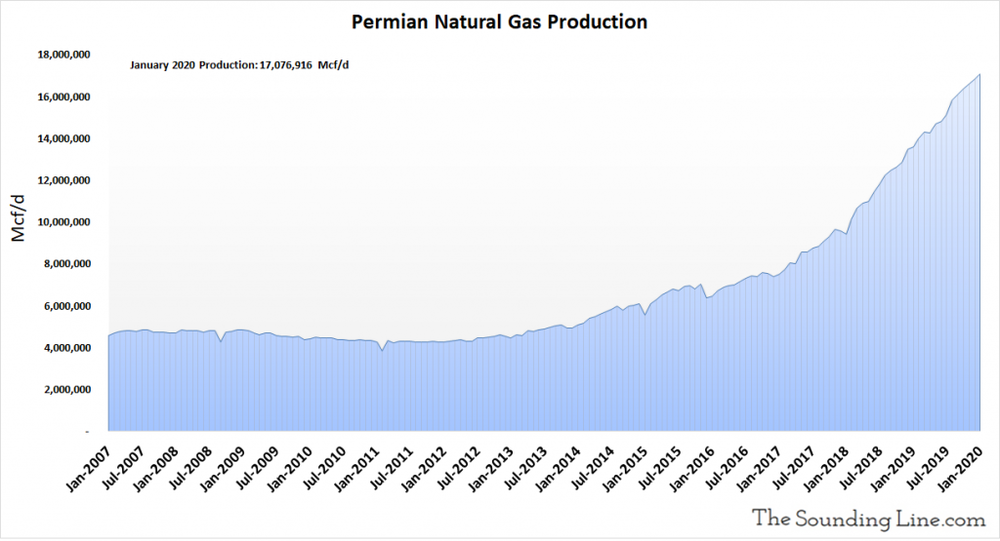

The Marcellus-Utica gas production increased ~ 15 BCFD from 2010-2015, and the Permian gas production increased ~ 11 BCFD from 2015-2020, either of which could have met Europe's demand but gas. There was a market demand that could not be satisfied by US production simply because the corresponding growth in infrastructure was prevented by governmental policies.

IMO, the productive gas capacity of the US has been "artificially limited" or "knee-capped" by governmental policies.