Everything posted by washparkhorn

-

[OFFICIAL DOOM THREAD]Today Democracy Dies

- 2021 - Is inflation finally back in the conversation?

- [OFFICIAL DOOM THREAD]Today Democracy Dies

- [OFFICIAL DOOM THREAD]Today Democracy Dies

Manchin and Sinema won't agree. McCarthy has already made plans. McCarthy already has plans:- Cryptocurrencies (Bitcoin, Ethereum, Litecoin, etc.)

So . . . LBRY is a security? The cryptotoken LBRY credits (LBC), issued by LBRY, a blockchain-based content hosting service, is legally a security according to a decision today from the U.S. District Court for New Hampshire. In a decision for summary judgment in favor of the Securities and Exchange Commission in the case SEC v. LBRY, Inc., which began in March 2021, U.S. District Judge Paul J. Barbadoro insisted the company violated Section 5 of the Securities Act of 1933 by selling its tokens without registering with and obeying SEC requirements for the legal sale of securities. . . . A rub in this decision that seems to be unnerving the crypto token community the most, a strong hint that those other digital assets might not remain "untouched" by the SEC for long, is it implies that any pre-mined token—which the issuers keep quantities of without spending money before releasing it into the marketplace at large—is thus obviously a security under SEC definition. https://reason.com/2022/11/07/cryptotoken-lbc-is-legally-a-security-federal-judge-declares-and-requires-regulation-by-the-sec/- [OFFICIAL DOOM THREAD]Today Democracy Dies

There’s the rub. Win or lose, Repubs will fuck around with the debt ceiling and ignorantly shatter confidence in the USD as the most favored reserve currency. That becomes the abyss for the US as we know it.- 2021 - Is inflation finally back in the conversation?

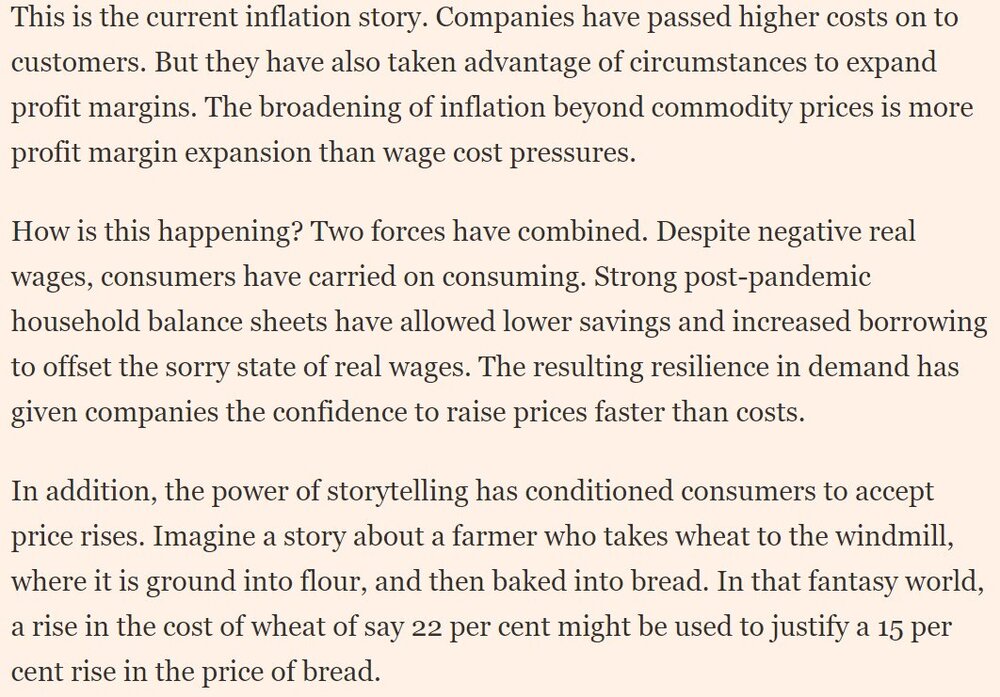

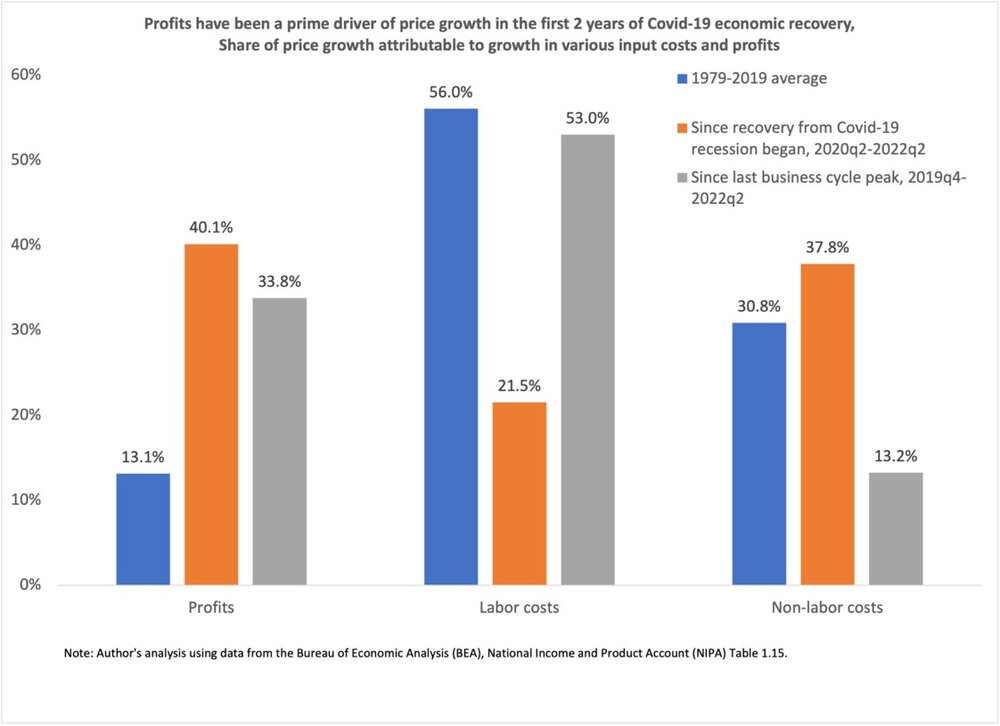

Fed should make clear that rising profit margins are spurring inflation Companies have taken advantage of circumstances to lift prices https://www.ft.com/content/837c3863-fc15-476c-841d-340c623565ae The writer is chief economist at UBS Global Wealth Management In the world’s financial markets, US Federal Reserve chair Jay Powell is increasingly cast in the role of playground bully — looming over the prostrate form of the global economy and chanting “hike, hike, hike” with malicious glee. US policy rates are rising relentlessly. However, Powell’s public remarks offer little insight into how he expects higher rates to tame inflation. The omission matters as the current policy tightening will have an impact through an unusual route. That is because today’s price inflation is more a product of profits than wages. The UBS chief economist is looking specifically at whether this is a wage/price spiral. It’s not, according to him. It has become lazy-thought for the Fed to raise the specter of a wage/price spiral and insinuate wages as the cause of inflation. They must do that because the inflation fighting tool they deployed crushes demand via unemployment - regardless of the cause for said inflation. It will work and create pain for most. But robust employment is not the primary cause.- Carpetbagging weasel faced smarmy little bitch, Ted Cruz

- The Twitter Debate

Elon needs an editor.- The Twitter Debate

- Disruption of the middle class

Further analysis- profits driving inflation: https://www.epi.org/blog/inflation-minimum-wages-and-profits-protecting-low-wage-workers-from-inflation-means-raising-the-minimum-wage/- Disruption of the middle class

source: Federal Reserve- Disruption of the middle class

The writer is chief economist at UBS Global Wealth Management: In the world’s financial markets, US Federal Reserve chair Jay Powell is increasingly cast in the role of playground bully — looming over the prostrate form of the global economy and chanting “hike, hike, hike” with malicious glee. US policy rates are rising relentlessly. However, Powell’s public remarks offer little insight into how he expects higher rates to tame inflation. The omission matters as the current policy tightening will have an impact through an unusual route. That is because today’s price inflation is more a product of profits than wages. TLDR: Financial Times: “Fed should make clear that rising profit margins are spurring inflation Companies have taken advantage of circumstances to lift prices”- Elon Musk: Nazi traitor piece of shit [Confirmed]

Agree. Just because the employees are "at-will," it doesn't mean no laws are involved. The most important one in a mass layoff is the WARN Act--Worker Adjustment and Retraining Notification Act. In California, if you terminate 50 or more employees in 30 days, you either have to provide 60 days' notice or pay them for 60 days. https://www.inc.com/suzanne-lucas/elon-musk-can-fire-anyone-he-wants-to.html- 2021 - Is inflation finally back in the conversation?

More jobs created than expected. 261 v. 193. Wages up, but not keeping up with inflation China ending Covid Zero policy rumor has commodities up.- Nancy Pelosi is a badass MF and I want her to be Speaker

- Texas MidTerm 2022 Early Voting Thread- Oct 24th-Nov.4th

- Texas MidTerm 2022 Early Voting Thread- Oct 24th-Nov.4th

Keep it going Austin young voters!- Let’s talk crime in America

- 2021 - Is inflation finally back in the conversation?

Terminal rate guess - 5.5%. One factor to consider: https://www.thesling.org/the-hidden-cause-of-economy-wide-inflation/ My claim is that platform MFNs are a hidden cause of the current macroeconomic inflation. An economy full of dominant intermediaries, all of whom use MFNs and their non-price equivalents, is an economy primed to turn private unilateral market power into widespread macroeconomic inflation when it comes time for recoupment.- Let’s talk crime in America

- 2021 - Is inflation finally back in the conversation?

Key moment of the press conference: Reporter: “Chairman Powell- the stock market is moving higher” (it wasn’t at that moment) Powell: ~ “fucking idiots.” Markets accelerate downward.- Markets still falling like whoa

Yields moving higher as well as the press conference continues.- 2021 - Is inflation finally back in the conversation?

The Fed promised pain and will not be satisfied until millions are put out of work. This is a Fed created problem with their commitment to the Fed Put (f/k/a the Greenspan Put). The Put was Fed Orthodoxy from 1997 - 2021. Clowns like Larry Summers had no problem with the Fed Put until very recently. tldr: if you cannot spot the sucker at the poker table, you are the sucker.- 2021 - Is inflation finally back in the conversation?

Football ... Basketball ... Baseball ... Other Sports ... Futbol ... 🤫995🤫 ... Gambling ... Movies & TV ... Music ... Hobbies ... Lulz ... Food & Travel ... Daily Texan ... Business & Markets ... Cloak Room ... Help ... For Sale ... Board Discussion ... Advertise... Tailgate DonationsBack to top - 2021 - Is inflation finally back in the conversation?

Account

Navigation

Search

Configure browser push notifications

Chrome (Android)

- Tap the lock icon next to the address bar.

- Tap Permissions → Notifications.

- Adjust your preference.

Chrome (Desktop)

- Click the padlock icon in the address bar.

- Select Site settings.

- Find Notifications and adjust your preference.

Safari (iOS 16.4+)

- Ensure the site is installed via Add to Home Screen.

- Open Settings App → Notifications.

- Find your app name and adjust your preference.

Safari (macOS)

- Go to Safari → Preferences.

- Click the Websites tab.

- Select Notifications in the sidebar.

- Find this website and adjust your preference.

Edge (Android)

- Tap the lock icon next to the address bar.

- Tap Permissions.

- Find Notifications and adjust your preference.

Edge (Desktop)

- Click the padlock icon in the address bar.

- Click Permissions for this site.

- Find Notifications and adjust your preference.

Firefox (Android)

- Go to Settings → Site permissions.

- Tap Notifications.

- Find this site in the list and adjust your preference.

Firefox (Desktop)

- Open Firefox Settings.

- Search for Notifications.

- Find this site in the list and adjust your preference.